As more and more resources are committed to digital assets, many governments are focused on catching bad actors in a bid to introduce some kind of regulations into the crypto-anarchist world of digital assets.

——

CANNES 2022 was bit by the cryptobug – celebrating films along with non-fungible tokens (‘NFT’) companies. Crypto startups and digital projects sponsored NFT-themed parties, events, a major conference, and even a new NFT-based film financing model at the Palais des Festivals et des Congrès, which hosted the prestigious film festival last month.

This, despite terrible conditions affecting the crypto market which has left an impact on the NYC.NFT event that ended on June 23, with the revelry interrupted by a series of bad crypto news.

Any digital work, like music albums, memes, and physical goods which can be represented in digital form like photo, video or scan, can be turned into an NFT. NFTs may also represent virtual locations like venues and real estate. On the metaverse, NFTs may represent personal identity and information.

The past few months have gained infamy with a major drop in value of several cryptocurrencies, the collapse of Terra-Luna and Celsius, and the plunging share price of cryptocurrency exchange giant Coinbase Global, that have hit the market hard and caused losses in billions of real dollar market capitalization.

With the two most valuable cryptocurrencies, Bitcoin and Ethereum, hit hard, attention has returned to the newest type of crypto asset – NFTs.

Also read: Cryptoassets in India: Is history repeating itself?

Is NFT a work of art?

NFTs are expected to make art more accessible to a larger consumer base, after gaining rave popularity last year as a way to invest in digital works of art and collectibles. But the underlying digital asset being bought is not art; they are digital tokens that represent something like digital art.

NFTs are a primary way Web3 and metaverse businesses are now innovating – not just on the internet and in virtual reality, but also in Hollywood. NFTs have inspired characters, become sought-after digital assets for celebrities, and brought up questions of intellectual property and digital rights management for the film industry.

Consumers need to be made aware of the limited rights they receive with their NFTs. Rarely, if ever, do buyers gain rights like copyright over the digital work itself, without regard to the amount of money spent on it.

Many online games use NFTs as a non-traditional gaming mechanism and some are centered on such non-fungible tokens. They are incorporated even in rules and player interactions where NFTs are found in-game, collected, and swapped with other players. Play-to-earn games allow users to earn by playing, but typically require an upfront investment to join.

With the hype going strong even outside art circles, it is important to understand NFTs and consider their full impact.

What is an NFT?

Any digital work, like music albums, memes, and physical goods which can be represented in digital form like photo, video or scan, can be turned into an NFT. NFTs may also represent virtual locations like venues and real estate. On the metaverse, NFTs may represent personal identity and information. Legally, these tokens are a mix of a deed, a certificate and membership rights.

Blockchains provide the technological solution for NFTs to authenticate digital asset transactions with rights conferred through tokens.

NFTs differ from other cryptoassets in a significant way – they are unique, so no two tokens can be swapped. This raises its value by making each NFT scarce and indivisible, unlike cryptocurrencies, which can be divided into smaller units.

Also read: Why India should start framing a law for the Metaverse

What are the consumer rights and regulatory pitfalls associated with NFTs?

Consumers must be wary in this fast changing environment, with ever-evolving crypto assets and hardly any regulations for the NFT market.

For instance, with digital art consumers, there is often confusion about ‘ownership’ of the digital work provided through a tokenized web link. Consumers need to be made aware of the limited rights they receive with their NFTs. Rarely, if ever, do buyers gain rights like copyright over the digital work itself, without regard to the amount of money spent on it.

There is a lot of confusion, and users don’t always know what they are getting into. They must consult the platform’s Terms and Conditions to know more about the work being purchased or the features of an NFT game. Users need to be informed that the links could die in the future without them having backed up the work. Limitations may extend to usage of bought work on social media and for commercial purposes. Token links and accompanying works may be replaced without the user’s knowledge or consent.

On the other end of the spectrum, any user who holds certain NFTs may gain rights over it, even if the tokens are stolen assets. This was the case with Hollywood actor, producer, writer and director Seth Green’s phished Bored Ape tokens which are owned by the platform Yuga Labs, and licensed with broad usage rights to anyone who holds it, even without the permission of the actual buyer. His tokens were finally returned after a lengthy negotiation which ended with him paying 165 Ether (USD 260,000) more for the stolen virtual goods.

The confusion and excitement around NFTs does not veil the limitations of a technologically unaware market.

In this scenario, crypto crimes and decentralized finance scams have become a norm. With NFTs, scams may take the form of ‘rug pulls‘, wherein fraudulent startups shutdown and disappear on users, thus pulling the rug from under their feet, usually after raising a significant amount of funds.

NFTs and virtual reality have become popular among whales as some consider them a better bet, with cryptoassets like Bitcoin and Ethereum having become too volatile lately.

Frosties – the NFT star of 2022, created a buzz as a new project that merged finance and art. Soon after selling out the tokens, the creators abruptly deactivated the website, and transferred an equivalent of USD 1.1 million to anonymous cryptocurrency wallets. Along with the money went the trust and goodwill essential to the success of tokenized digital art projects. The creators were caught even after using multiple transactions to obfuscate the original source of funds. In the ongoing case against them, the defendants were charged with wire fraud and conspiracy to commit money laundering.

As more and more resources are committed to digital assets, many governments are focused on catching bad actors in a bid to introduce some kind of regulations into the crypto-anarchist world of digital assets. According to blockchain data and analysis firm Chainalysis, rug pulls have become a major form of fraud, making up nearly 40 per cent of crypto scams and costing users about USD 2.8 billion last year, up from just one per cent the previous year.

What is the role of ‘whales’?

In the cryptocurrency market, whales hold the most amount of tokens. Whales may be individuals, institutions, and exchanges like MicroStrategy, Pantera Capital and Fortress Investment Group.

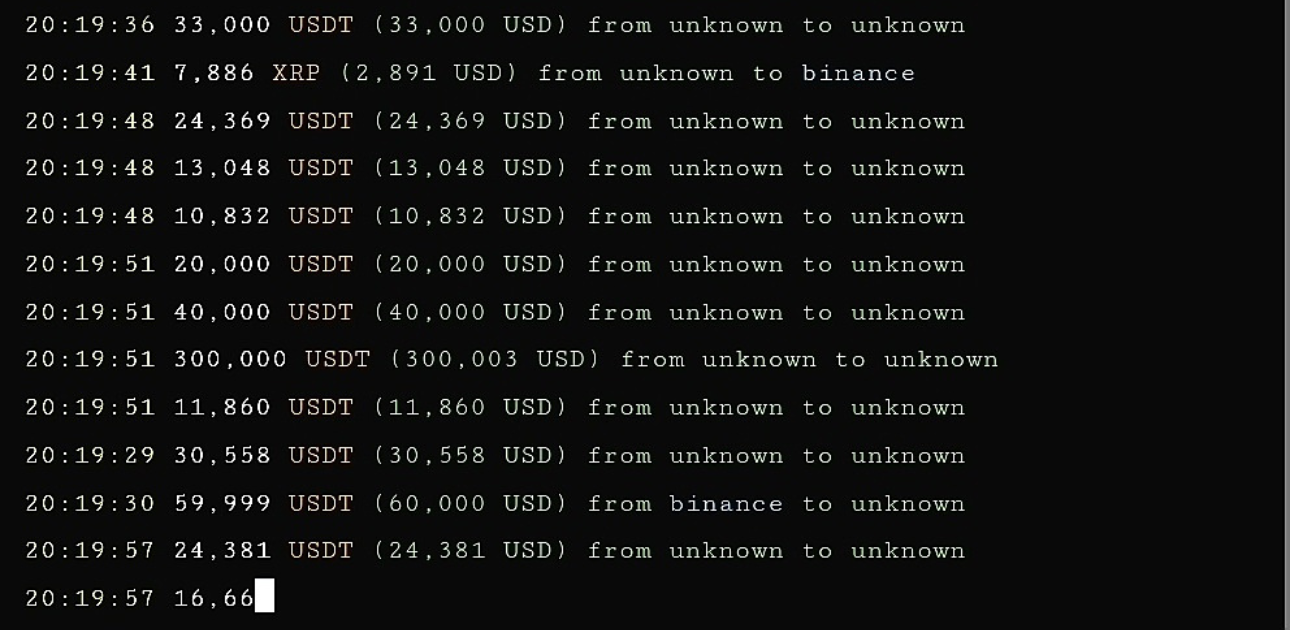

Whales hold large amounts of at least one particular cryptocurrency, without selling them, in order to make profits in the future. This practice is called ‘hodling‘. In this way, whales not only make massive profits, but also influence investments in the market and manipulate currency valuations. For traders interested in making a profit on the crypto market, the movement of whales is particularly notable, and tracked daily through whale alerts on social media platforms.

According to Chainalysis’ 2022 Crypto Crimes report, the cryptocurrency holdings among cyber criminals saw a massive surge in 2021, rising from around USD 3 billion in 2020 to over USD 11 billion in 2021. Crypto criminals now account for roughly 4 per cent of all whales in the industry.

NFTs and virtual reality have become popular among whales as some consider them a better bet, with cryptoassets like Bitcoin and Ethereum having become too volatile lately. Due to the uniqueness of the market, it has its own giant whale model. Broadly, the term ‘giant whales’ refers to investors with strong NFT purchasing power and who have made considerable profits, such as Vignesh Sundaresan a.k.a. ‘MetaKovan’, and ‘dingaling’.

Noting the potential of NFTs for powering a new world of digital commerce, ownership, and community, NFT platform Origin co-founder and pioneer in the non-fungible space, American entrepreneur Matthew Liu stated that “we’re still in the early innings, and the NFT buying experience is – unfortunately – notorious for all sorts of fraud, from false listings and fake offers to clickbait and bot-driven malicious activity”, while launching NFT marketplace builder ‘Collection’, which claims to combat cybercrime.

Also read: Delhi court agrees to look into legality of futures and derivative trading in cryptocurrency

Virtual land on metaverse has quickly become the most highly sought after digital asset. Until now, it is a relatively small number of people, largely whales, driving up land prices on these worlds. It is not too far in the future when regular investors, with 1-100 BTC or less in their wallets, will soon follow suit, without the same fail-safes that are available to whales, such as real estate.

It is not surprising then, that while the bearish crypto market seems to have recovered somewhat, regulators are coming down hard on crypto assets, and investors in the blockchain sector will soon be required to follow new laws.